Introduction

Chevron Corporation (NYSE: CVX) is an American multinational oil company energy corporation that trades on the New York stock exchange and has a market cap of $187 billion. The company is one of the largest publicly traded oil corporations and commonly regarded as one of the supermajor along with ExxonMobil (NYSE: XOM), Royal Dutch Shell (NYSE: RDS.A)(NYSE: RDS.B), Total S.A. (NYSE: TOT), and British Petroleum (NYSE: BP).

Like all other major corporations, Chevron has had a difficult time over the past two years since the start of the corporation. One of two oil dividend aristocrats that was once considered the darling of the oil business world, Chevron has seen its stock price drop from almost $134 before the crash all the way down to lows of $75 during August 25 crash lows.

Since then, the company has experienced a startling recovery watching its stock price increase to $100 per share, a 33% share price gain over the past 8 months. At the same time, the company still yields 4.25%, a very respectable yield. While the yield is impressive, Chevron's recent activity is out of line with its earnings and the oil markets and I recommend investors sell at this time and wait for a better point to reinvest.

First Quarter Highlights

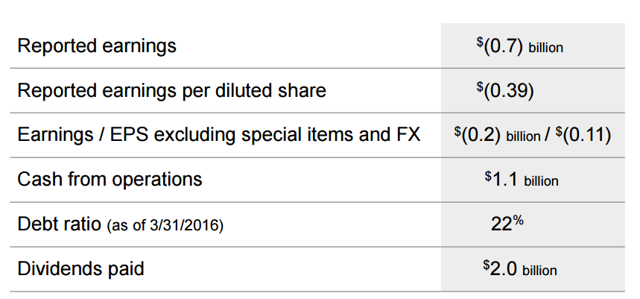

Let us begin by reviewing Chevron's first quarter highlights.

Chevron reported first quarter 2016 highlights of -$0.7 billion or -$0.39 per diluted share an impressive amount for a $190 billion company. The company's cash from operations was $1.1 billion with the company having a 22% debt ratio. At the same time, the company paid $2.0 billion in dividends amounting to 1% of the company's market cap.

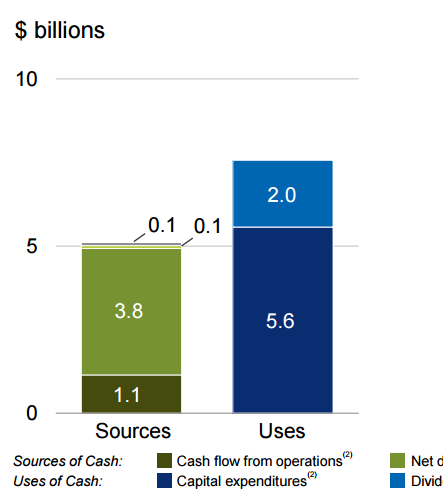

Chevron Cash Usage - Chevron Investor Presentation

To delve further into these earnings, the above image represents my disappointment with Chevron's earnings. The company had a mere $1.1 billion of cash flow from operations during a quarter when oil prices averaged approximately $35 per barrel. Current oil prices of $45 are materially higher, but even then oil prices are expected to remain low for the next two to three years.

As a result of this immense shortfall, the company was forced to raise $3.8 billion of debt providing it with $4.9 billion still leaving the company with a $0.7 billion shortfall to cover even its Capex. The company was still forced to come up with another $2.0 billion to cover its dividend. That means even in a single quarter when the company raised its debt by almost 10%, it still came up $2.7 billion short for its spending requirements. Yet the company saw its stock price go up 33%.

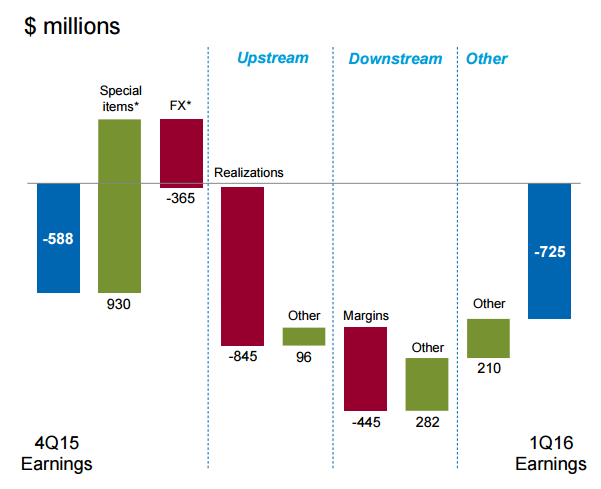

Chevron Earnings Change - Chevron Investor Presentation

The above image provides a comparison of its first quarter 2016 earnings compared to 4Q 2015 earnings. The company's earnings dropped by $0.15 billion due to a $9/barrel decline in brent crude prices. That means even in the current quarter where oil prices are averaging $10/barrel or higher, the company's earnings will still remain -$0.5 billion as they were in the 4Q.

However, there is also something else important to see here. Since the start of the oil crash, a number of oil producers have been held up by a rapid increase in downstream margins. However, these margins have begun collapsing as more producers attempt to take advantage of them and this cost Chevron more than $0.5 billion.

Idealized Situation

Now that we have talked about Chevron's first quarter highlights, let us talk about the company's idealized situation over the coming years. This should give us a preliminary picture of Chevron's fair valuation.

The above chart provides an overview of the oil demand and supply balance up until the fourth quarter of 2016. In the third quarter 2013, the oil supply and demand balance first went out wack and it took approximately 9 months for the market to begin dropping followed by another 6 months before the market hit its first low in January 2015. That means we can assume 15 months from the resumption of balance until prices stabilize.

According to the above graph, which obviously changes according to the passage of time and the passage of trade agreements from cartels such as OPEC, the demand and supply balance are expected to recover approximately 9 months. Let us add another 15 months for prices to recover and that gets us 24 months of low prices which for simplicity purposes we will assume hold at the current price of $45 per barrel.

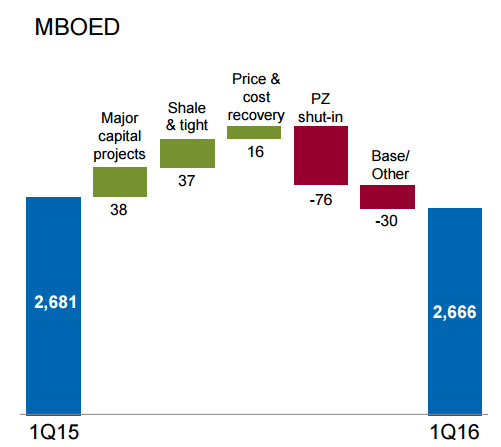

Chevron Oil Production - Chevron Investor Presentation

The above image provides an overview of Chevron's production which for the first quarter 2016 averaged 2.67 million barrels per day. Here I want to also highlight something different. Chevron's enormous recent capex costs have come from a number of recent capital projects. While these capital projects will see their capex costs drop significantly as they come online their production is still not outweighing the decline of production as assets are sold or shut down.

Multiplying this by the next 24 months at 2.67 million barrels per day means that the company will produce almost 2 billion barrels per day before a recovery in oil prices. Based on the company's fourth quarter earnings 2015 where prices were around $45 per barrel and where the company lost $0.5 billion, we find that the company loses approximately $5 per barrel from production.

Now that we have that, let us start our math by inputting the company's cost for this production, $10 billion. At the same time, over this two year period, the company will continue yielding its impressive 4.25% dividend yield causing it $16 billion, assuming no dividend increases. That means $26 billion of cost, or 13% of the company's market cap over the next two years before we even think about Capex.

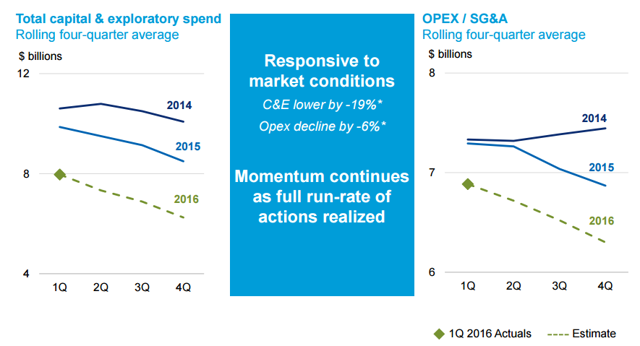

Chevron Capex - Chevron Investor Presentation

At the same time, the company's capex is expected to decrease rapidly but not fast enough maintaining at $6 billion in 4Q 2016. With Chevron's history of cost overrun on the major projects this capex is funding, we will assume an average of $6 billion per quarter for the next 8 quarters in capex. Here is where the real issue comes in as the company's capex over the next two years will amount to $48 billion.

That means Chevron's total cost until a recovery in oil prices where the company's profitability can cover the company's costs and reward its investors. However, getting to this point over the next two years, ignoring what has already happened will cost the company $74 billion. At the company's 2014 peak when oil prices were $100+ per barrel, the company's market cap was $250 billion. Now it is $190 billion. That is a $60 billion drop.

And yet, we have already determined that the company will have $74 billion in cost just to survive the next two years, which means its present valuation is overvalued by $14 billion or almost 10% at a minimum. More importantly, this is the idealized case. Even with an eventual recovery in oil prices, the chance of these prices reaching $100+ per barrel again by mid-2018 is incredibly unlikely.

Potential Catalysts

Now that we have a deep overview of the company's first quarter highlights along with an overview of how the company's share price is inflated even under an ideal scenario where prices recover to $100+/barrel in two years, let us talk about the potential catalysts that will potentially increase Chevron's valuation.

Chevron Asset Sales - Chevron Investor Presentation

Chevron's 2016 - 2017 asset sale target of $5-10 billion will cover approximately 10% of the company's cash shortcoming taking a mid-point of the goal. The above map provides an indication of the transactions, including those in progress and those under consideration.

And here's the interesting thing. If Chevron is overvalued in this market, you can bet so are its top assets. There is a reason Chevron has been a top oil company for a century and its competitors know it, that is Chevron's ability to find and develop assets. If Chevron needs to sell its best assets to earn money, you can bet competitors will be lining up.

Higher asset sales will allow Chevron to sell undeveloped assets over the next two years giving it additional revenue without hurting its production.

Chevron Major Projects - Chevron Investor Presentation

At the same time, the Gorgon and Wheatstone LNG projects represent the company's two major project startups which it has spent $10s of billions on albeit starting at a time of oil price highs. The project has reached a production rate of 90 thousand barrels per day before it was stopped for repairs.

However, the project is expected to restart in May and in conjunction with the Wheatstone LNG project which is expected to have first output in mid-2017, we will see a material impact on Chevron's production. This will provide the company with profits that can help offset its additional costs. At the same time, as the company's projects come online, it will see its capex costs come down significantly.

That means while we can expect $74 billion in costs for the next two years, should the crash last for example 4 years, the costs will go nowhere near doubling and instead I would expect to stay around $100 billion for 4 years since we will be able to subtract out significant capex costs.

My Take

Chevron remains one of the most significant oil majors in existence producing several percent of the world's production and that cannot be ignored. The company also has a relatively low 22% debt ratio and this includes $10s of billion of spending on major materially impactful projects.

However, when I look deeper at the numbers, more importantly the company's cash burn compared to its profits, these numbers paint an ugly picture over the coming few years. Even if oil prices recover in two years, that still means the company is overvalued compared to its 2014 highs not even its 2010 - 2014 average when prices were $100 per barrel.

Don't get me wrong, Chevron is an amazing company and I have previously recommended investing in the depths of the crash when the company was in the low $80s per share, or a market cap $30 billion less than the present one. At those prices when the company was yielding 5% or more it offered long-term investors an amazing opportunity to involve themselves with a long-term oil growth company.

At present prices, I don't expect the dividend to get cut. However, if the oil crash lasts longer than expected or if the company's credit rating drops due to its rapid increase in debt, investors could rapidly sell off resulting in a rapid drop in the company's share price and wiping out any potential gains from dividends.

0 коммент.:

Post a Comment