Chevron (NYSE:CVX) has reported first quarter 2016 results on Friday morning, missing estimates and reporting numbers that were overall worse than expected. The company's cash burn rate remains problematic, and Chevron needs to get back on track in the coming months or the company's share price could get hurt.

Chevron reported revenues of $23 billion for the first quarter, down $9 billion from last year's first quarter revenues of $32 billion. Pre-tax losses came in at $1.7 billion, down from pre-tax earnings of $2.9 billion in Q1 2015. Chevron's net income totaled $730 million, which means a loss of $0.39 per share. Chevron missed earnings per share estimates by $0.19.

Chevron's weak performance was expected as environmental conditions have not been good for Chevron's upstream operations, nor for Chevron's downstream operations.

Oil prices averaged $34 per barrel in the first quarter, well below last year's first quarter average of $54 and the fourth quarter average of $44 (thus oil prices declined by $10 on a quarter to quarter basis and by $20 year on year). It is thus not surprising that Chevron's upstream earnings dropped to $1.5 billion, which reflects lower realized prices and a very small production decline (down 0.5% year on year).

Downstream earnings, which have been very solid in last year's first quarter (at $1.4 billion) were cut in half, the $700 million in downstream earnings could thus not offset the losses from Chevron's upstream operations.

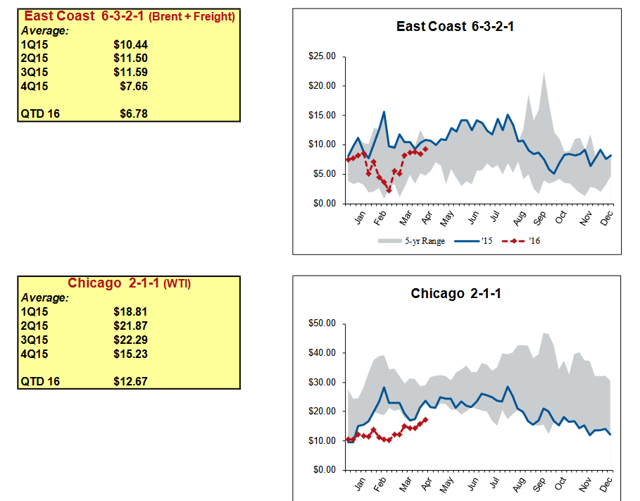

Chevron's lower downstream earnings can be blamed on lower crack spreads globally: East Coast crack spreads are down by $4 per barrel, Chicago crack spreads are down by $6 per barrel (on a year on year basis), and crack spreads in other regions (including Europe, Singapore, Gulf Coast and West Coast) are down as well. These lower crack spreads were responsible for Chevron's lower downstream earnings, and as long as crack spreads do not increase substantially over the coming months, Chevron's future downstream earnings for the current year will continue to lack behind the comparative numbers from 2015.

The worst number for Chevron, however, was not the revenue number, and neither the net loss. I believe the worst result Chevron had to report on Friday was the high cash burn rate in the first quarter. Chevron was able to produce $1.1 billion in operating cash flows in Q1, down from $2.3 billion in operating cash flows in last year's first quarter. During the first three months of the current year, Chevron spent $6.5 billion on capex, which means the company's free cash flow totaled $5.4 billion. This was not all of the cash Chevron burned through though, the company additionally paid out $2.0 billion to its owners in dividends. This gets us to a total cash burn rate of $7.4 billion in just one quarter, which equals an annual cash burn rate of $29.6 billion. I do not believe Chevron will burn through almost $30 billion in the current year, since oil prices have recovered substantially from the Q1 level. Future operating cash flows should come in higher again, but even at half the first quarter's burn rate, (i.e. $3.7 billion per quarter) the company would burn through close to $20 billion in just one year.

Chevron's financials have not been getting better over the last years: Over the last four years Chevron's cash position has dropped from $20 billion to $11 billion, at the same time Chevron's liabilities grew by more than $20 billion, and the company's long-term debt grew by roughly $30 billion over those three years. These numbers do not include the first quarter's cash burn and debt built yet, so you can imagine that these numbers got even worse over the last months. I don't believe that Chevron is in any way threatened to go bankrupt, after all, the company's interest coverage is still very high, and the debt to equity ratio is not very high either. Nevertheless, the declining cash amount and the rapidly growing long-term debt position are nothing investors should cheer about. Depending on how long oil and gas prices trade at a low level, Chevron could be forced to cut the dividend or increase the pace of asset sales, both wouldn't be good for shareholders at all.

Takeaway

Further revenue declines and higher losses were expected. The company's upstream business, as well as its downstream operations were pressured.

The real issue for Chevron is its high cash burn rate (of close to $30 billion on an annualized basis). Chevron should focus on cutting costs if oil prices do not grow substantially, or the company might be forced to cut the dividend and/or increase the asset sales pace - both would be bad for investors.

0 коммент.:

Post a Comment