Baker Hughes Inc. gained even after reporting a larger-than-expected first-quarter loss as a financial crisis in the oil industry forces explorers to slash spending.

The world’s third-biggest oil services provider reported a net loss that widened to $981 million, or $2.22 a share, from a loss of $589 million, or $1.35 a share, a year earlier, Baker Hughes said Wednesday in a statement. Excluding certain items, the loss of $1.58 a share was worse than the 33 cent average loss that 32 analysts surveyed by Bloomberg had predicted ahead of the release.

Investors shrugged off the loss, pushing shares up 2.3 percent to $46.86 at 2:33 p.m. in New York. Baker Hughes earlier rose to $47.67. Oil climbed above $45 a barrel for the first time since November.

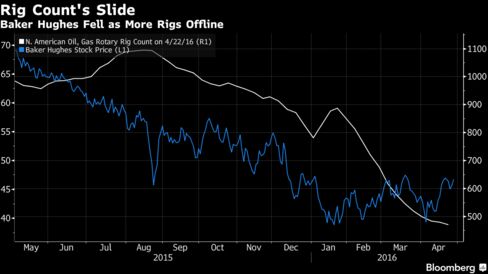

In North America, its largest region, Baker Hughes reported an operating profit margin of negative 21.2 percent, compared to negative 2.5 percent in the same period last year, according to the statement. The North American rig count, which fell by a third in the first three months of the year, is expected to drop another 30 percent in the second quarter from the first-quarter average, Chief Executive Officer Martin Craighead said in the statement.

"The industry faced another precipitous decline in activity, exceeding even the most pessimistic predictions, as E&P companies further cut spending in an effort to protect cash flows," Craighead said. "For the second half of the year, we project the U.S. rig count will begin to stabilize, although we do not expect activity to meaningfully increase in 2016."

Houston-based Baker Hughes has until the end of the month to close its deal with rival Halliburton Co. in a pact combining the world’s No. 2 and No. 3 oil service providers. Halliburton delayed its earnings release from April 25 to May 3, a signal that one or both of the companies may terminate the merger, Brad Handler, an analyst at Jefferies, wrote Sunday in a note to investors.

Baker Hughes said Wednesday it’s holding onto costs of more than 25 cents per share that can’t be cut because of its merger agreement.

0 коммент.:

Post a Comment