Currency bloc beats forecasts but inflation slips back into negative and experts urge against reading too much into data

ECB could face more pressure to keep deflation at bay after latest figures. Photograph: Michael Probst/AP

Friday 29 April 2016 11.58 BSTLast modified on Friday 29 April 201622.00 BST

The eurozone economy grew faster than expected in the first three months of 2016, but inflation in the single currency bloc has fallen back into negative territory, putting more pressure on the European Central Bank to keep deflation at bay.

Official statistics showed GDP in the 19-nation eurozone rose 0.6% in the first quarter despite a backdrop of turmoil on global markets at the start of the year. It was the fastest growth for a year and twice the pace recorded in the closing quarter of 2015. GDP was up 1.6% on a year earlier.

The quarterly performance beat growth in the UK, which reported a slowdown to 0.4% GDP expansion earlier this week and also outperformed the world’s biggest economy, the US. Eurozone GDP.

The eurozone reading was better than economists had been expecting, with a Reuters poll before the release pointing to 0.4% growth. But some experts warned that the single currency region could have a tougher second quarter and that the first quarter figures could yet be revised lower when more information comes in.

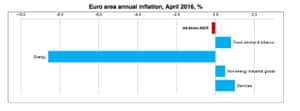

Other data from EU statistics office Eurostat showed that inflation in the eurozone dropped to -0.2% in April, compared with zero inflation in March. The early estimate for April showed energy prices were the biggest drag on inflation, falling by an estimated 8.6% on the year.

FacebookTwitterPinterest Lower energy prices helped pull down eurozone inflation. Illustration: Eurostat

The April reading marks the second dip below zero for eurozone inflation this year and follows a warning last week from ECB chief Mario Draghi that inflation could turn negative again in coming months.

Friday 29 April 2016 11.58 BSTLast modified on Friday 29 April 201622.00 BST

The eurozone economy grew faster than expected in the first three months of 2016, but inflation in the single currency bloc has fallen back into negative territory, putting more pressure on the European Central Bank to keep deflation at bay.

Official statistics showed GDP in the 19-nation eurozone rose 0.6% in the first quarter despite a backdrop of turmoil on global markets at the start of the year. It was the fastest growth for a year and twice the pace recorded in the closing quarter of 2015. GDP was up 1.6% on a year earlier.

The quarterly performance beat growth in the UK, which reported a slowdown to 0.4% GDP expansion earlier this week and also outperformed the world’s biggest economy, the US. Eurozone GDP.

The eurozone reading was better than economists had been expecting, with a Reuters poll before the release pointing to 0.4% growth. But some experts warned that the single currency region could have a tougher second quarter and that the first quarter figures could yet be revised lower when more information comes in.

Other data from EU statistics office Eurostat showed that inflation in the eurozone dropped to -0.2% in April, compared with zero inflation in March. The early estimate for April showed energy prices were the biggest drag on inflation, falling by an estimated 8.6% on the year.

FacebookTwitterPinterest Lower energy prices helped pull down eurozone inflation. Illustration: Eurostat

The April reading marks the second dip below zero for eurozone inflation this year and follows a warning last week from ECB chief Mario Draghi that inflation could turn negative again in coming months.

The ECB has been criticised by Germany’s finance minister, Wolfgang Schäuble, who claimed record low interest rates were causing “extraordinary problems” for German banks and pensioners and risked fuelling the rise of anti-EU sentiment in Germany. But Draghi has sought to stress that loose policy was needed to get inflation back to the central bank’s target of “below but close to” 2%.

Policymakers will take some comfort from the GDP figures, however. The pick-up in growth for the eurozone region follows news earlier on Friday that the French economy expanded a faster-than-expected 0.5% in the first quarter on the back of a big jump in consumer spending.

The first quarter performance marked the fastest growth for a year and compared with 0.3% in the previous three months.

Austria’s economy also beat market forecasts with first quarter growth of 0.4% and Spain grew a solid 0.8%, matching the previous three months.

Separate Eurostat figures showed unemployment in the eurozone fell to 10.2% in March from 10.4% in February.

There were parallels between the lower unemployment rates and faster GDP growth for the eurozone, said Bert Colijn, senior eurozone economist at ING bank.

Policymakers will take some comfort from the GDP figures, however. The pick-up in growth for the eurozone region follows news earlier on Friday that the French economy expanded a faster-than-expected 0.5% in the first quarter on the back of a big jump in consumer spending.

The first quarter performance marked the fastest growth for a year and compared with 0.3% in the previous three months.

Austria’s economy also beat market forecasts with first quarter growth of 0.4% and Spain grew a solid 0.8%, matching the previous three months.

Separate Eurostat figures showed unemployment in the eurozone fell to 10.2% in March from 10.4% in February.

There were parallels between the lower unemployment rates and faster GDP growth for the eurozone, said Bert Colijn, senior eurozone economist at ING bank.

“Domestic strength in the eurozone economy is key to current economic growth. This is mostly because of improvements in the job market. In March, unemployment declined by more than 200,000 people in the eurozone,” said Colijn.

But he added a word of warning about the GDP figures: “Although this release is certainly encouraging, it remains to be seen whether this figure is not subject to substantial revision.”

Howard Archer, economist at the consultancy IHS Global Insight, said improved eurozone GDP growth in the first quarter of 2016 was likely underpinned by decent consumer spending while the evidence from France and Austria indicated that business investment was healthy.

German GDP figures are yet to come, but the region’s biggest economy was likely to have put in a strong performance, said Archer.

“We suspect first quarter eurozone GDP growth was also lifted appreciably by markedly increased expansion in Germany – indeed, it could well have doubled – while we also expect there to have been modest improvement in growth in Italy,” said Archer.

“The ECB will certainly be encouraged by the marked first quarter pick-up in eurozone GDP growth and will no doubt argue that it shows its monetary policy is working. The improvement … also reinforces belief that the ECB will remain in ‘wait and see’ mode for the next few months despite the eurozone seeing renewed deflation of 0.2% in April.”

But Alasdair Cavalla, senior economist at the Centre for Economics and Business Research, warned against reading too much into one quarter’s GDP figures.

“This is the fastest rate of output growth since the first quarter of 2015 for the eurozone and its timing is propitious given the numerous sources of anxiety for the continent. However, false dawns have been common since the financial crisis and nowhere more so than in Europe,” said Cavalla.

But he added a word of warning about the GDP figures: “Although this release is certainly encouraging, it remains to be seen whether this figure is not subject to substantial revision.”

Howard Archer, economist at the consultancy IHS Global Insight, said improved eurozone GDP growth in the first quarter of 2016 was likely underpinned by decent consumer spending while the evidence from France and Austria indicated that business investment was healthy.

German GDP figures are yet to come, but the region’s biggest economy was likely to have put in a strong performance, said Archer.

“We suspect first quarter eurozone GDP growth was also lifted appreciably by markedly increased expansion in Germany – indeed, it could well have doubled – while we also expect there to have been modest improvement in growth in Italy,” said Archer.

“The ECB will certainly be encouraged by the marked first quarter pick-up in eurozone GDP growth and will no doubt argue that it shows its monetary policy is working. The improvement … also reinforces belief that the ECB will remain in ‘wait and see’ mode for the next few months despite the eurozone seeing renewed deflation of 0.2% in April.”

But Alasdair Cavalla, senior economist at the Centre for Economics and Business Research, warned against reading too much into one quarter’s GDP figures.

“This is the fastest rate of output growth since the first quarter of 2015 for the eurozone and its timing is propitious given the numerous sources of anxiety for the continent. However, false dawns have been common since the financial crisis and nowhere more so than in Europe,” said Cavalla.

0 коммент.:

Post a Comment